Trans Americas – The Next Wave

- January 22, 2024

The Transformative Rise of Submarine Cables in Latin America and the Caribbean

By Lynsey Thomas and Eckhard Bruckschen

Submarine cables, often unsung yet integral to the digital age, serve as the internet’s backbone, facilitating the transmission of over 98% of global internet traffic through a vast network of 400 active submarine cable systems covering an astounding 1.2 million kilometers. The pressing need for new networks arises as Latin America and the Caribbean grapple with escalating bandwidth demands, experiencing a remarkable annual growth rate surpassing 30%. This surge is propelled by evolving trends led by hyperscalers and content providers, projected to command over 80% of global internet traffic by 2027. Streaming, mobile usage, cloud data centers, artificial intelligence (AI), virtual reality (VR), and 5G technology contribute significantly to this surging demand.

Despite the soaring bandwidth requirements, the region confronts formidable challenges in internet access and connectivity. Issues such as limited competition, monopoly pricing, reliance on outdated submarine systems, and the imperative for Caribbean and South American nations to connect to the US for internet access pose significant obstacles. Furthermore, existing regional cables approach the end of their operational life, lacking the necessary accessibility, capacity, and scalability to meet rapidly escalating future demands.

Compounding these challenges is a noteworthy transformation in the ownership profile of submarine cable systems. While initially consortium-owned, a pivotal shift is occurring, with global technology giants like Google, Apple, Meta, and Netflix increasingly investing in and driving demand for these critical infrastructure components. This shift holds significance in addressing the mounting bandwidth requirements spurred by evolving consumer and industry trends.

In-region activity

New build activity is required to break the monopolistic status-quo created by mergers in the region, to foster competition and to incentivise cost-based pricing for essential internet services. Once the pricing challenges and bandwidth limitations of the existing infrastructure are addressed with new systems, we can expect the market to grow.

Several systems have been announced over the past decade (AURORA, CSN-1, TIKAL, Caribbean Express, Cayman Express, GD-1, LN-1 and TAM-1), all designed to replace the ageing infrastructure and add diversity to the region.

The AURORA Cable System from FP Telecommunications (FPT) signed a turn-key agreement with ASN in 2017, whilst being acquired by Abu Dhabi Investment Group. Announcements of investment in the submarine cable market followed – however so far, no further activity has been reported on this Caribbean deployment.

All these proposed new systems offer to address the risks associated with the existing carriers’ end-of-life infrastructure, offering a much-needed upgrade to support the region’s evolving digital landscape.

Trans Americas Fiber System: First Past the Post?

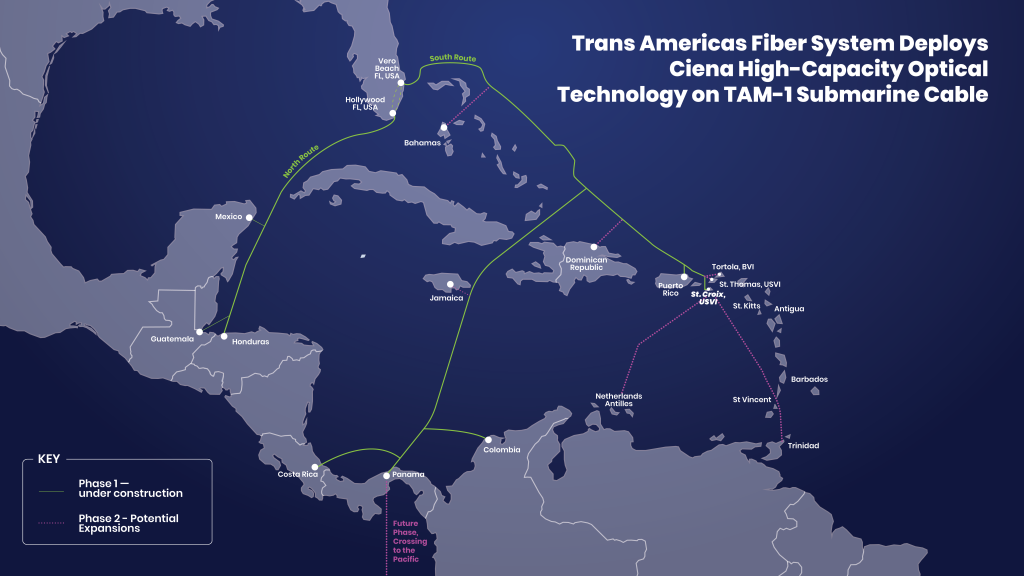

Earlier this year Trans Americas Fiber System announced the start of construction of their Trans Americas-1 (TAM-1) system. TAM-1’s design boasts a substantial increase in high-speed capacity, featuring 36 fiber pairs (24 + 12) that will collectively deliver a staggering 648 Terabits per second bandwidth. This leap in capacity is set to address the escalating demand for data transmission, setting the stage for a more connected and digitally empowered region.

Indeed, with a Ready for Service date of 2025 it looks like TAM-1 is set to reshape the region’s digital landscape, while contributing significantly to its socio-economic development. The drivers for the system are multi-fold:

- Cross Caribbean Route: providing a solution for national Caribbean carriers and Government grappling with their Digital Economy efforts and the increasing demand for bandwidth.

- Diverse Path for North-South Traffic: introducing a diverse and redundant path for North-South traffic, offering an alternative to existing systems along the Pacific and Caribbean coastline of Central America.

-

Reducing the Digital Divide: bridging the digital divide in Latin America and the Caribbean by fostering growth and private investment in the region. As digital infrastructure is a key catalyst for economic development, TAM-1 is expected to improve competitiveness and attract further investments.

The TAM-1 cable system will span a length of 7,000 kilometers (4,350 miles), establishing a high-speed route from the US (Florida) to a diverse set of countries including the Northern Caribbean (Puerto Rico, US Virgin Islands, and the British Virgin Islands), Central America (Mexico, Guatemala, Honduras and Costa Rica), and South America (via Colombia, Panama and the Netherlands Antilles). Designed to offer strategic reach, connecting key regions to foster economic growth, and offering route diversity and state-of-the-art technology from system supplier, Xtera.

The team at Trans Americas Fiber recently reported that EGS had completed the marine survey operations in Florida, Puerto Rico, St Croix, St Thomas, Tortola, Colombia, Panama and Costa Rica. The final stages of the geophysical survey for Mexico and north central America will be performed by the Fugro Gauss early this year.

Future Expansions and Additional Systems

It remains to be seen which additional new systems will start construction in 2024 and which plans will fall by the wayside. The team at Trans Americas are already planning for Phase 2, an extension which will encompass the Eastern Caribbean (St. Kitts, Antigua, Barbados, St. Vincent, and Trinidad and Tobago) as well as an extension to the Pacific towards Ecuador, Peru and Chile. An expansion which promises to amplify connectivity, bringing advanced digital infrastructure to previously underserved areas.

Whatever the outcome, recent activity represents a transformative change in the region. New systems offering improved cable alternatives, bolstering high-speed capacity, and comprehensive connectivity will be welcomed across the Americas region.

Related Post

-

TAF System Deploys Ciena High-Capacity Optical Technology On TAM-1 Submarine Cable

TAF System Deploys Ciena High-Capacity Optical Technology On TAM-1 Submarine Cable -

Optimizing Network Capacity Through Shared Spectrum Solutions

Optimizing Network Capacity Through Shared Spectrum Solutions -

Securing Connectivity In The Digital Era

Securing Connectivity In The Digital Era -

Exclusive: Trans Americas mulling new subsea cable in LatAm

Exclusive: Trans Americas mulling new subsea cable in LatAm -

How Trans Americas Fiber System Plans to Make a Splash

How Trans Americas Fiber System Plans to Make a Splash

Renewing Connectivity Across the Americas

Resources

Contact Us

- Get in touch

- info@transmaericasfiber.com

Copyright 2026, Trans Americas Fiber. All Rights Reserverd.

- Terms of Services

- Privacy Policy